About Lime Loan

One of the most reputable online lenders in South Africa, Lime Loans, provides a quick, easy, and open way to borrow money. Lime Loans lets South Africans obtain the money they require without the hassle of typical bank loans because of its simple application process, quick approvals, and same-day payouts. Here are all the things you should know before asking for a loan from Lime Loans if you’re thinking about doing so.

More loan options are available on Lafingo loan comparison table

Business information

- Company Name: Lime Loan

- Website: www.limeloans.co.za

- Company Number: 2015/239349/07

- Contact: Phone – 010 442 6722, Email – support@lime24.co.za

- Working Hours: Monday to Friday: 8:30 AM – 5 PM

Loan services:

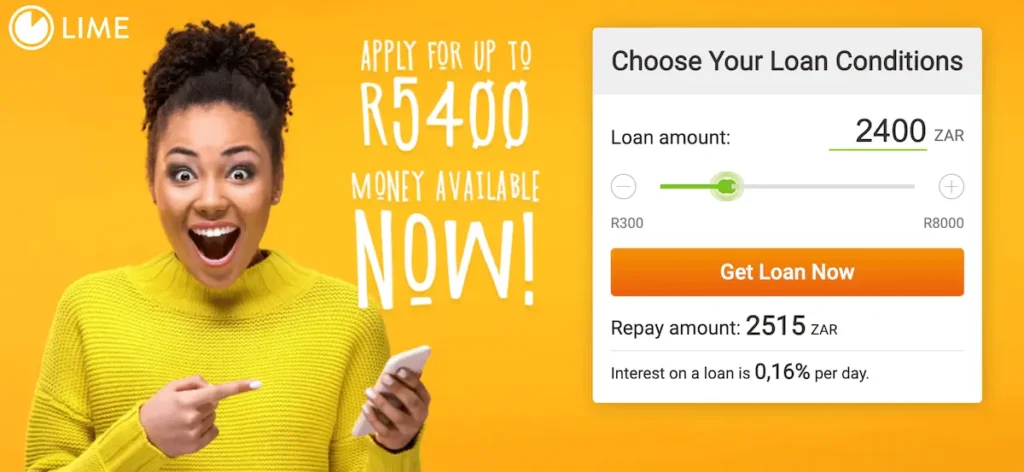

- Quick Loan: Up to R5,000 (1 – 4 months). Disbursed within 5 minutes for major SA bank account holders.

- Personal Loan: Up to R8,000 (168-day repayment term).

- Flexible Terms: Loan amounts range from R500 to R8,000 with repayment periods of 91 to 168 days.

Eligibility criteria:

- South African citizen/permanent resident with a valid SA ID.

- Age 18 – 65.

- Stable income with proof (payslips or bank statements).

- SA bank account holder with internet banking access.

Terms & Conditions

- Interest Rates & Fees: Rates vary based on loan amount, credit history, and repayment period.

- Processing & Disbursement: If all conditions are met, funds are transferred within 5 minutes.

- Privacy Policy: Lime Loans respects the User’s privacy and the User’s right to keep personal information private and confidential.

- Late Payments & Penalties: Late or missed payments may incur penalty fees and additional interest.For more details, visit www.limeloans.co.za or contact support@lime24.co.za.

How does Lime Loans operate in 2025?

Lime online loans application requirements are seamless and make borrowing quick and easy. This is how to apply for Lime loan online:

- Go to the Lime Loans website and complete the easy loan application.

- You will receive a prompt response when your application has been completed, which should take only a few minutes.

- If approved, the money is transferred directly to your bank account, often within the same day.

- This means no paperwork, no long queues, and no waiting for days—just a simple way to access the money you need when you need it.

Key features and benefits of Lime Loan

These are the elements that set Lime apart from other loan lenders in South Africa.

- Fast Approval Method: Lime Loans is a fantastic choice for anyone in immediate need of money because it approves applications in a matter of minutes.

- Flexible Loan Amounts: The loan amount you take out can be adjusted to meet your needs.

- Instant Payments: If the loans are accepted, the funds are often transferred to your banking account on that same day.

- 100% Online Application: There is no need to go to a physical branch; you can apply from any location using a computer, tablet, or smartphone.

You can prevent future needless financial stress by borrowing responsibly. Do you require a loan right now? Get the money you require easily, quickly, and securely by applying with Lime Loans!

Frequently Asked Questions – ❓

-

How fast can I get a Lime Loan?

-

How much can I borrow from Lime Loans?

-

Can I apply for a Lime Loan if I have a bad credit history?

-

Is it safe to reveal my bank account number?

-

Can I take out another loan while I still have an active Lime Loan online?