About Dengoo

Dengoo.co.za is one of the top non-bank financiers in South Africa because of its ethical loan issuance practices. They offer a simple and safe way to obtain the money you require, whether it be for urgent travel, home repairs, or medical expenses. However, is it the best option for you? Let’s examine Dengoo, loans in more detail, including their advantages, how they operate, and things to think about before applying.

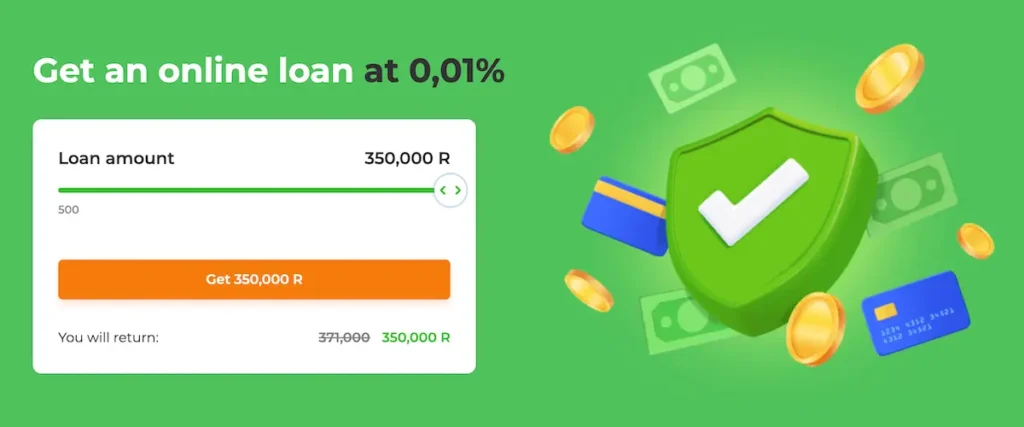

Easy, fast and reliable – it’s all about Dengoo. Get a loan approval immediately! Loan sum up to 350,000 R

Get a loan!

Business information of Dengoo in South Africa

- Company Name: “Dengoo”

- Customer Support: Available 24/7 via phone, email, or chat.

Loan services:

- Maximum Loan Amount: up to R 350,000.

- Flexible Repayment Terms: 1 day to 365 days.

- Interest Rates: 3.65% – 58.4% annually, depending on the loan amount and credit profile.

Eligibility criteria:

- South African citizen/permanent resident with a valid SA ID.

- Age 18 – 65.

- Stable income with proof (payslips or bank statements).

- SA bank account holder with internet banking access.

Terms & Conditions

- Processing & Disbursement: Approved loans are transferred within 15 minutes.

- Repayments & Early Settlement: Repayments are automatically deducted on due dates.

- Late Payments & Penalties: Late or missed payments may incur additional fees and impact future loan eligibility.

How to apply for Dengoo.co.za loans online in 2025?

Dengoo simplifies the loan process by offering an entirely online application. Here’s how it works:

- Visit the Dengoo.co.za website and complete a short loan application form with your personal and financial details.

- The system processes your application within minutes and gives you a decision right away.

- If approved, the money is deposited into your bank account—often on the same day.

With no need for physical paperwork or long queues, Dengoo makes borrowing quick and stress-free for South Africans.

Key features and benefits of Dengoo loan in ZA ✅

Here are the benefits you get when you opt for Dengoo as your preferred loan provider.

- Instant loan approvals: Dengoo processes applications almost immediately, ensuring that borrowers get a quick response—so you’re not left waiting for days to know if you qualify.

- Flexible loan amounts: You are provided with loan amounts suited to different financial needs.

- No hidden fees

- Secure and confidential: Dengoo uses advanced security measures to ensure that all personal and financial details are kept safe during the loan process.

Why choose Dengoo.co.za? ⭐

- They offer you access to a broad network of online loan providers across South Africa.

- You don’t have to worry about delays in loan processes. They offer quick loan approvals, ensuring you get the funds you need instantly.

- With Dengoo.co.za loan online, you enjoy a hassle-free application process without much paperwork.

Frequently Asked Questions❓

-

How long will it take to receive money on my card❓

-

Can I request several loans at once at Denzoo.co.za❓

-

How soon can I receive my loan from this lender❓

-

Can I repay my loan early❓