A guide to Moneycat loan online

Moneycat quick loan promises an easy and fast way of getting the cash you need. Borrowers can complete the application form in as fast as five minutes. Moneycat loans online offer an all-digital loan application with customers getting their money the next day.

Moneycat Philippine online loans is a registered online lending platform with a Certificate of Authority To Operate Number: 1254 from the Securities and Exchange Commission (SEC). This Pasig-based online loan company operates under SEC Registration number CS201953O73

Read other loan reviews on Lafingo.

How Moneycat online personal loan works

Loan amount – Moneycat online loan lets customers borrow Php 500 to Php 20,000. The lender, however, may choose to approve a smaller amount than what the borrower requested.

Repayment period – Loan online Moneycat can be repaid from seven days to 30 days. Moneycat may choose to shorten the loan term during the application process depending on the outcome of its credit scoring and system evaluation.

Interest rates – Moneycat loan online charges an interest rate of 11.9% per month and a maximum of 145% annual percentage rate (APR).

• First-time borrowers of Moneycat are given a 0% interest rate and zero processing fee.

• Repeat borrowers can get competitive rates according to their preferred loan term and amount. Those with good credit standing and history will enjoy better interest rates.

How to apply for Moneycat loan online

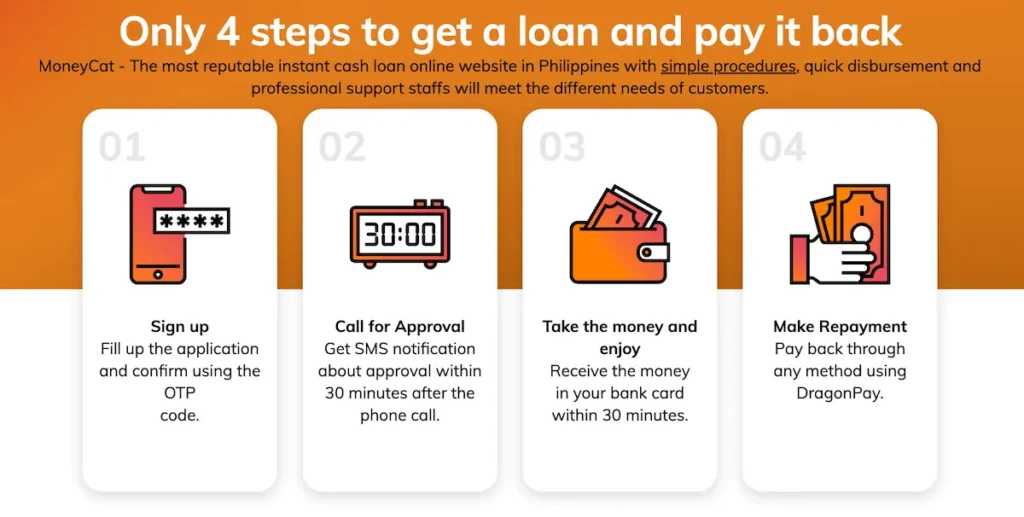

The Moneycat loan online application and approval process is 100% digital. There is no need for physical presence or queuing for hours. Simply have your mobile phone on hand ready to receive a call and enter the One Time Pin (OTP). This way, borrowers can save on borrowing costs.

Here’s how the Moneycat loan application online process works.

- Sign-up – Fill out the application online. This process only usually takes five minutes

- Enter the OTP – At the last part of the application form, you will be asked to enter the OTP. Make sure to enter an active mobile phone number and have your phone within your reach as you fill out the application.

- Wait for the call – You can only obtain the Moneycat personal loan online application approval after an agent has verified your information. During this phone call, you will be asked to confirm the conditions, terms, and contracts of the online loan. Be prepared to get receive a phone call shortly after you complete the application form.

- Sign the contract – You will need to sign the contract via an SMS code.

- Get your cash – Moneycat will make the cash loan available to your nominated bank account. Make sure to provide the correct bank account details to prevent any delays.

Online application requirements

Below are the requirements to apply for the Moneycat loan online.

- At least 22 years of age

- Filipinos residing in the Philippines

- Presently employed or can prove a steady source of income

- With an active bank account in their names

- With an active, personal mobile number

- With a government-issued ID such as Passport, Driver’s License, SSS, TIN, UMID, or Voters ID

Options for repaying Moneycat Loan

Online loan Moneycat provides various options for borrowers to repay the loans.

- Online

- Payment centers

- Over the Counter Banking

- Digital Wallets

Frequently Asked Questions (FAQ)❓

-

What if I accidentally gave the wrong bank information?

-

How can I get in touch with the Moneycat online loan team?

-

Can I apply for a repeat Moneycat Philippines online loan?

Read customer reviews about Moneycat in 2025 ⭐

I’m happy with MoneyCat because they didn’t require a lot of documents. The repayment terms were manageable, though the app could provide more detailed explanations.

MoneyCat was easy to use, and the loan approval was fast.

Great service for emergency funds! MoneyCat disbursed the loan quickly!

MoneyCat helped me during a tough time, and I appreciate their fast approval process. However, the app could use some improvement as it’s not very intuitive.