About Finpug

In South Africa, Finpug is regarded to be one of the most reliable online lenders. They provide same-day payouts and a quick, entirely online application process. This implies that you may submit applications from any location and get money without worrying about needless delays or lengthy paperwork. But is Finpug your ideal lender? Let’s go over all the information you require on their loans.

More loan options are available on Lafingo loan comparison table

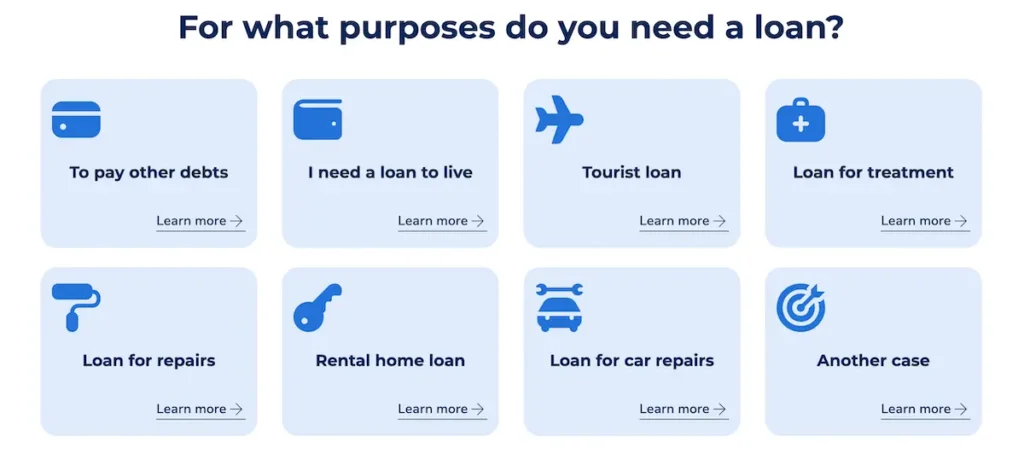

Get the best loan offers with Finpug. Different purpose loans up to 250,000 R

Get a loan!

Business information

- Company Name: “Finpug”

- Working Hours: Applications accepted 24/7.

- Customer Service: You can reach specialists via phone, email, or chat.

Loan services:

- Quick Loan: Up to R8,000 (1 month – 2 years). Funds disbursed within 5 minutes for major SA bank account holders.

- Personal Loan: Up to R100,000 (1 – 4 years).

- Long-term Loan: Up to R250,000 (25 – 60 months).

- Flexible Terms: Borrowers can choose repayment periods from 7 to 365 days.

Eligibility criteria:

- South African citizen/permanent resident with a valid SA ID.

- Age 21 – 70.

- Stable income with proof (payslips or bank statements).

- SA bank account holder with internet banking access.

Terms & Conditions

- Interest Rates: Rates vary based on loan amount, repayment term, and credit history.

- Processing & Disbursement: If all requirements are met, funds are transferred within 15 – 30 minutes.

- Repayments Terms: Monthly repayments are automatically deducted from the borrower’s account.

- Late Payments & Penalties: Late or missed payments may incur additional fees and penalty interest.

How to apply for Finpug.co.za loan online in 2025

South Africans can easily apply for a loan through Finpug’s 100% online application process without having to go to a bank or wait in line. This is how it works:

- Visit the Finpug site and complete a brief application for a loan.

- Finpug evaluates your application in a matter of minutes and makes a judgment right away.

- If your loan is accepted, the money is often transferred to your financial account that same day.

- Finpug is a good option if you need a loan quickly and without any hassles.

Are you prepared to apply? Get the quick, safe, and hassle-free financial assistance you require by visiting Finpug right now!

Key features and benefits of Crezu loan

These are the features that makes Finpug stand out amid other loan providers in South Africa:

- Simple and fast loan application process: You can apply for a loan with Finpug online in just a few minutes without having to leave your house.

- Quick approvals for loans: You won’t have to endure waiting weeks or months for a response because the majority of loan applications are completed promptly.

- No unstated charges with Finpug, transparency is essential. There won’t be any surprises because you’ll be given a detailed explanation of your repayment schedule, interest rates, and costs up front.

Frequently Asked Questions

-

How soon can I apply for a Finpug loan?

-

How much is the highest amount of funding I can request?

-

Can someone with a poor credit history qualify for a Finpug loan?

-

Is collateral required in order to obtain a loan at Finpug?

-

How can I pay back my loan from Finpug?

-

If I currently hold a loan, can I request for another one?